When your money is working hard, you don't have to.

Start putting your money to work with RF Mutual Funds.

Transaction Form Open A New Account View our BSD Funds View our USD Funds

What is a mutual fund?

In simple terms, a mutual fund is an investment product that pools money from many different people to invest in a portfolio of stocks and/or bonds. Funds are managed by professionals who decide which stocks or bonds to buy, and investors benefit from the performance of the portfolio. Mutual funds typically earn higher returns than a traditional savings account, between 5% and 10% depending on the type of fund*.

Mutual funds are designed to fund long-term financial goals like saving for a child’s college education or retirement. They may not be right for you if you will need your funds within five years. They may also not be right for you if you do not wish to take on any investment risk, or if you are unwilling or unable to withstand fluctuations in the value of your portfolio.

Saving versus investing

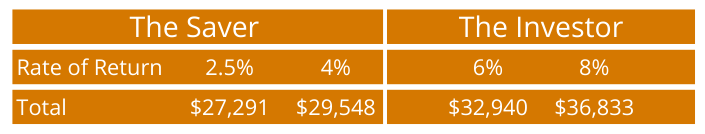

The rate of return matters. Even if you are a consistent saver, due to the impact of inflation, you could still be losing purchasing power. This means that the rate of return on a typical savings account is not enough to account for the rising cost of living. So, while it is important to save, it is even more important to get the best possible returns on your money. This is the difference between saving and investing and is illustrated in the table below. By making monthly contributions of $200 into a mutual fund for 10 years, you could significantly increase your earnings and create a more stable financial future.

*Assumed rate of return based on the historical performance of different investments. Actual returns may vary.

*Assumed rate of return based on the historical performance of different investments. Actual returns may vary.

RF Mutual Funds

Offering more mutual funds than any other company in The Bahamas, RF Mutual Funds are designed to match any investor’s risk tolerance. We offer low, medium and high-risk investment options and the flexibility for investors to scale up or down based on their specific investment goals. Our experienced Investment Specialists provide expert management of a diversified portfolio as part of a strategic investment plan. We also offer competitive fees and an ‘easy pay’ option for subscriptions.

Benefits of RF Mutual Funds

-

Convenience: With mutual funds, you can purchase a well-researched portfolio of investments without all the guesswork. They are monitored continually giving you the confidence of knowing your money is working for you.

-

Affordability: You can start investing with an initial investment as low as $500.

-

Access to your money: You are not locked in. You can redeem your funds during any month of the year. Your investment choice is not locked in either. You can switch your money between any of the funds at no additional charge.

-

Access to markets: Mutual Funds hold a wide range of investments and provide access to markets that you may be unable to buy or reach on your own, ultimately lowering your overall risk.

-

Professional management: Our team of Investment Specialists are comprised of knowledgeable experts specifically trained to evaluate investment opportunities based on the potential to generate returns while controlling for risk.

We are proud to offer some of the best performing mutual funds in the market. We maintain key relationships with world-renowned asset managers that help us provide market-leading results year after year. Also, given our position as a leading investment bank, we can provide access to both Bahamian Dollar Mutual Funds and US Dollar Mutual Funds.

The next step

Getting started on your investment journey is not complicated at all. You can set up your mutual fund investments in lump sums from time to time or on a scheduled periodic basis. An Investment Specialist will go over your preferences with you and help you set up your investment.

Contact us to get started today!

1.png)

.png)