Many individuals are familiar with bank term deposits and how they work. A fixed time period and a fixed interest rate make your eventual re-turn easy to calculate up front: $100,000 @ 4% interest for one year will earn $4,000 of interest and result in a balance of $104,000 at the end of that year (assuming no money was taken from or added to the account during that period).

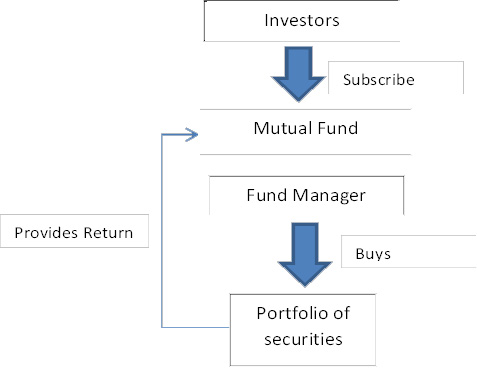

MUTUAL FUND INVESTMENT PROCESS

Mutual fund returns, however, are not generally fixed or guaranteed. Rather, the value of a fund goes up or down depending on the value of the underlying assets.

Mutual fund shareholders benefit when the price of their shares increases, which corresponds to an increase in value of the underlying portfolio of securities that a fund buys. As the overall portfolio increases in value, so does the overall value of the fund and the individual shares in that fund.

There are two basic ways that individual securities within a mutual fund portfolio increase in value:

- Capital Appreciation

These are gains in the actual price of a security. Depending on the specific investment objective, a manager might look to buy stock for the portfolio because he believes the price will rise in the future. Perhaps company earnings are improving, or the company occupies a position in the market that has come into favor. Whatever the reason, as the securities in a fund’s portfolio increase in value, so does the overall value of the fund, and in turn, the individual price of the shares.

HOW A FUND DETERMINES ITS SHARE PRICEMarket Value of a Fund’s Assets, including income and capital appreciation.Example:

$6,000,000Fund’s liabilities, including fees and expenses.Example:

$60,000Number of Investor Shares Outstanding.Example:

500,000Fund Share Price or Net Asset Value (NAV)Example:

$11.88If an investor buys $100,000 worth of fund shares at a price of $10 per share, for example, he will receive 10,000 shares. If those same fund shares increase in value to $12 three years later--due to the increase in value of the underlying portfolio--that investor’s holding in the fund becomes worth $120,000, for a gain of $20,000, or 20% over the three-year period.

- Income

Although many mutual funds do not typically pay dividends or interest directly to shareholders, investors can, nonetheless, profit from the income the portfolio generates. Income from underlying securities is reinvested into the fund, which, in turn, raises the overall assets of the fund and increases the price per share in a manner similar to the previous example.

Investors who redeem their shares in the fund at a higher price than they bought them realize a gain that is typically made up of both capital gain and income.

The price of shares in a mutual fund is known as the Net Asset Value or NAV. This figure is determined by the fund’s Administrator, using a fairly straightforward equation.

Whether a mutual fund calculates its official NAV daily, weekly, monthly, or based upon some other time frame is determined by the fund’s Board of Directors. Many funds follow long-standing tradition within their own country to determine the frequency, but overall market activity and liquidity also play a part in the decision. Most Bahamian mutual funds determine their NAV either on a monthly or quarterly basis. Subscriptions into and redemptions from a fund are processed at the same time.

When an investor decides to take some or all of his money out of a mutual fund, it’s called a redemption. Mutual funds typically require investors to provide some period of notice beforehand, typically 15 days to a month. This restriction gives the fund’s manager adequate time to manage the necessary liquidity to pay redemptions and assure a stable flow of monies both in and out of the fund.